Bill Moore’s insurance used to be as predictable as his car.

“Reliable, economical. Twenty-nine miles to the gallon. You can’t beat that,” says Moore.

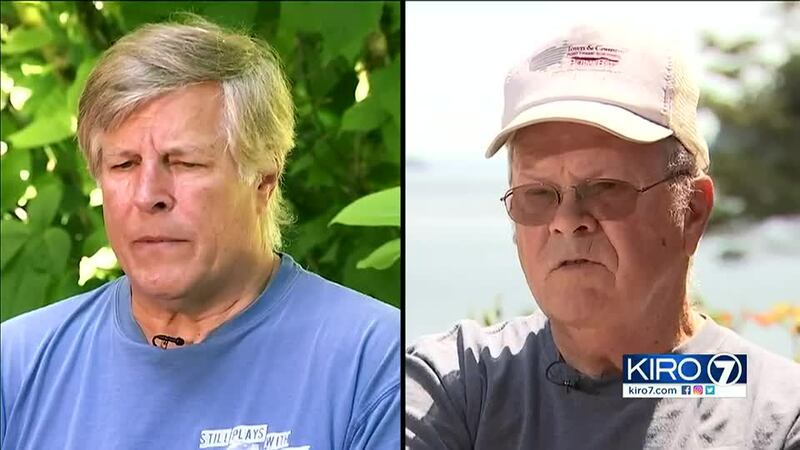

But the Anacortes resident says he’s the one taking a beating now because the insurance for his 2003 Camry is going up 26%.

“I thought it was ridiculous,” he says.

The premiums for Wayne Berthold’s 19-year-old BMW Z-3 are up 40%.

“Our records are really clean, no claims,” he says.

Both men say their insurers informed them that the state Insurance Commissioner’s temporary emergency order ending the use of credit scores to determine premiums caused the rate hikes.

“I thought that was penalizing people that have worked their life and tried to maintain a good credit rating,” says Moore.

So what about the man who made it happen?

“Hell no! I won’t back down from this one,” says Washington Insurance Commissioner Mike Kreidler.

Kreidler says he’s planting his feet and standing firm on his decision.

“Jesse, I believe that you’ve got to do the right thing,” says Kreidler.

But they’re blaming you!

“I know they are,” he says. “Some of these companies that are now turning around and blaming me already had a rate increase request in place before they lost the use of credit scoring. But they never mention that.”

Kreidler enacted the emergency rule after SB 5010, a bill that would do the same thing permanently, failed in the legislature. In March, he told me the use of credit scores was unfair to the poor and communities of color.

“We’re very sensitive to the people who are being harmed,” said Kreidler in March. “Let’s get this out there before any more people get hurt.”

The insurance lobby then provided an ominous prediction.

“There’s a high risk that the price of insurance will be going up because credit scores have been shown to be a way in which insurers can help reduce the cost of insurance for consumers,” said Kenton Brine, President of the Northwest Insurance Council.

Piilani Benz, an independent insurance agent with Alliance West in Tacoma, says she sees that playing out.

“It’s a lot of our more retired clients or other individuals on fixed incomes,” says Benz. “I don’t want to have them lose coverage overall.”

Benz says she’s seen rates go up for seniors and students. But so far, those aged between 30 and 50 are getting breaks.

“I have seen a lot of clients that have had rates go down,” she says.

There’s one point Benz and Kreidler agree on—shop around for a deal.

“If you are with one company and your price is going up, I have 50 other companies that I can look at for you,” says Benz.

If you want to know the details of your rate increase, file a complaint with the Insurance Commissioner’s office.

Here’s why: we found a case where a consumer complained that their rate was going up 28% because of the credit scoring issue.

“When we did our review, we found out that a small portion was due to credit,” says Kreidler.

That portion was just 7% of the overall increase.

Still, the rate jumps are real. For Berthold, it’s auto insurance now. The home policy is next.

“And that’s what really is frustrating,” says Berthold. “The other shoe to drop!”

Follow our reporting from the beginning:

- Emergency rule temporarily bans credit scoring to set insurance rates

- Bill to take credit scoring out of insurance rates dies in the Senate

- Seattle NAACP among dozens of groups now supporting full ban on credit scoring in insurance

- Insurance industry helped write changes that regulator says ‘gutted’ bill to take credit scoring out of insurance

- Race, credit scoring, and the most expensive neighborhood for car insurance in Washington

Email Jesse right now at consumer@kiro7.com

©2021 Cox Media Group